Financial stress amongst your employees has a costly impact on workplace productivity, retention, and overall employee well-being.

Employees who say they are stressed about their finances

Lost per week due to financial stress

Annual cost of lost productivity and engagement

More likely to be looking for a new job

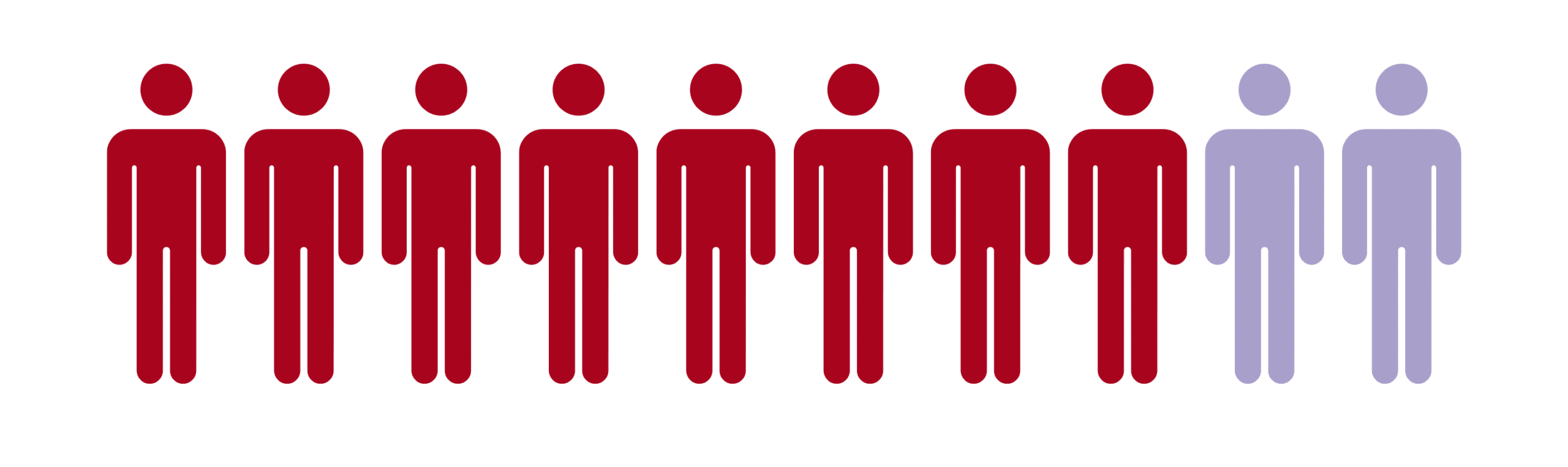

There is a driving desire and demand amongst employees for financial wellness to be taken seriously by their employer. When looking at two different studies, 76%-87% of employees feel their employer should play a role in supporting their wellness. What’s more, 96% of employers AGREE with this idea, yet only 2 out of 5 employers offer financial wellness programs.

At Prosperity Connection, we offer a comprehensive Employer-Sponsored Financial Education (ESFE) program designed to boost your employees’ financial well-being and contribute to your company’s overall success. Our non-profit status ensures an unbiased, education-focused approach tailored to your employees’ needs.

Our financial education and coaching services can be offered virtually or on-site, as well as in English and Spanish.

The Results Speak For Themselves

Nearly 8 out of 10 respondents have received bad financial advice.

of all respondents have made financial mistakes due to bad advice

of all respondents report they have made serious financial mistakes

A study by Employee Benefit News reveals the percentage of participants who felt “highly stressed” about personal finances dropped from 52.4% to 19.2% after completing a financial wellness program.

of employees say they would be positively impacted by having access to financial wellness benefits, becoming more committed to their company, likely to stay longer, and more productive

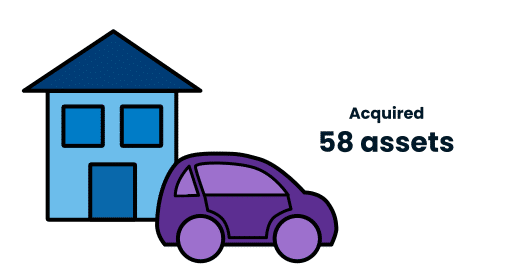

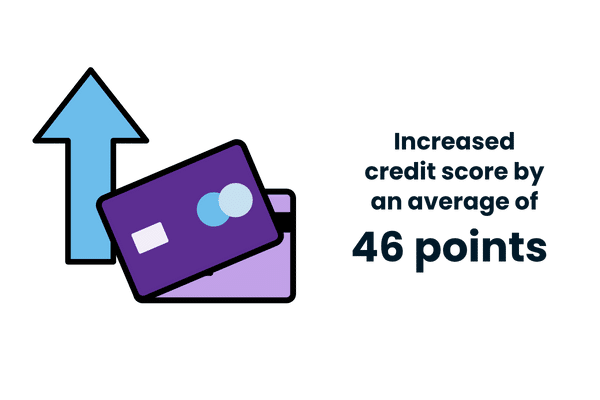

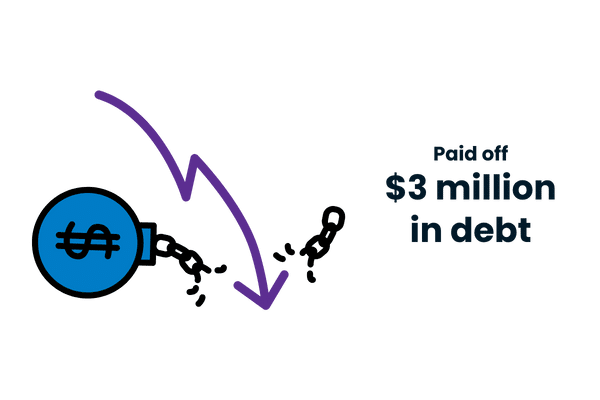

Since 2020, our clients have:

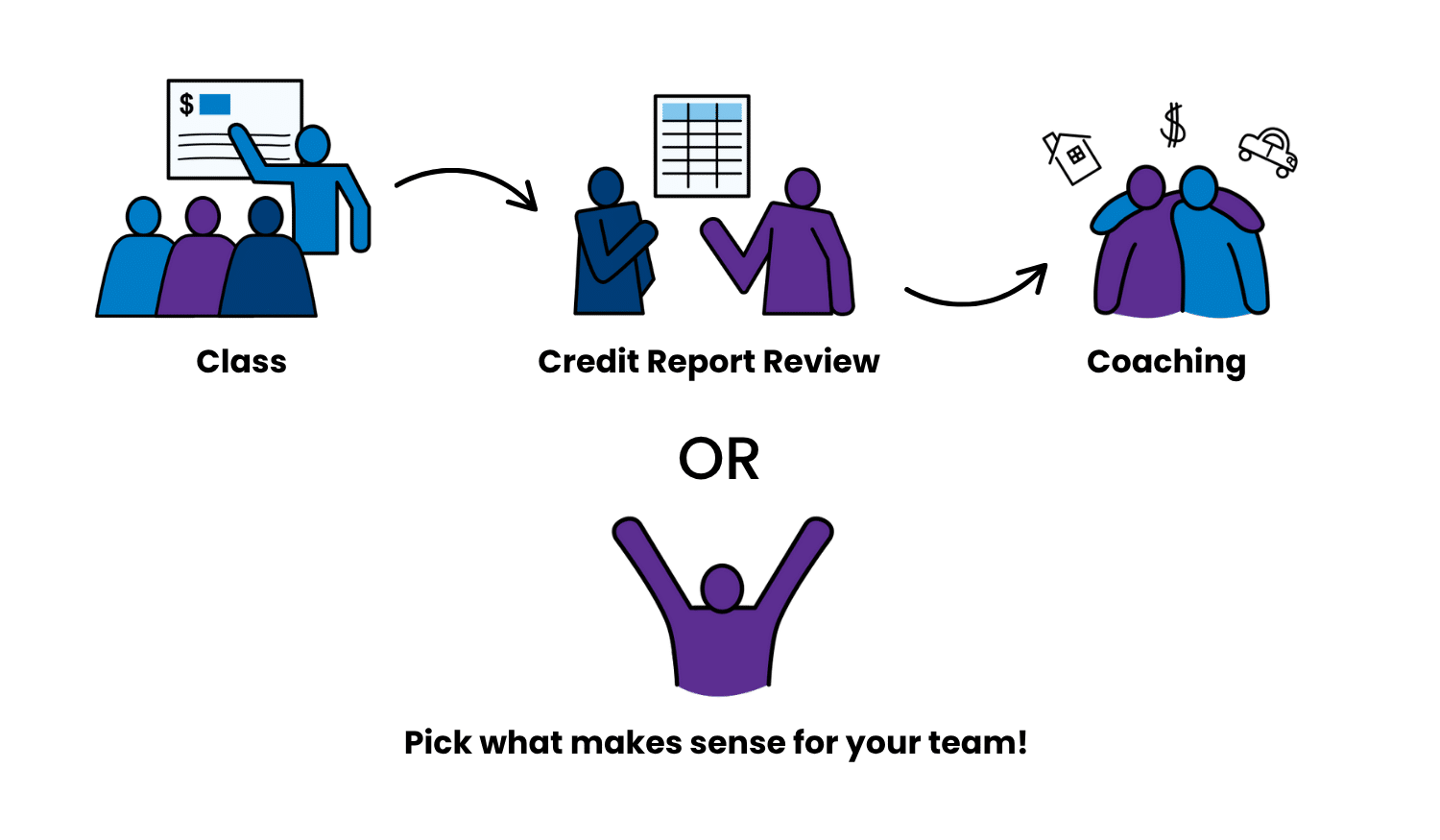

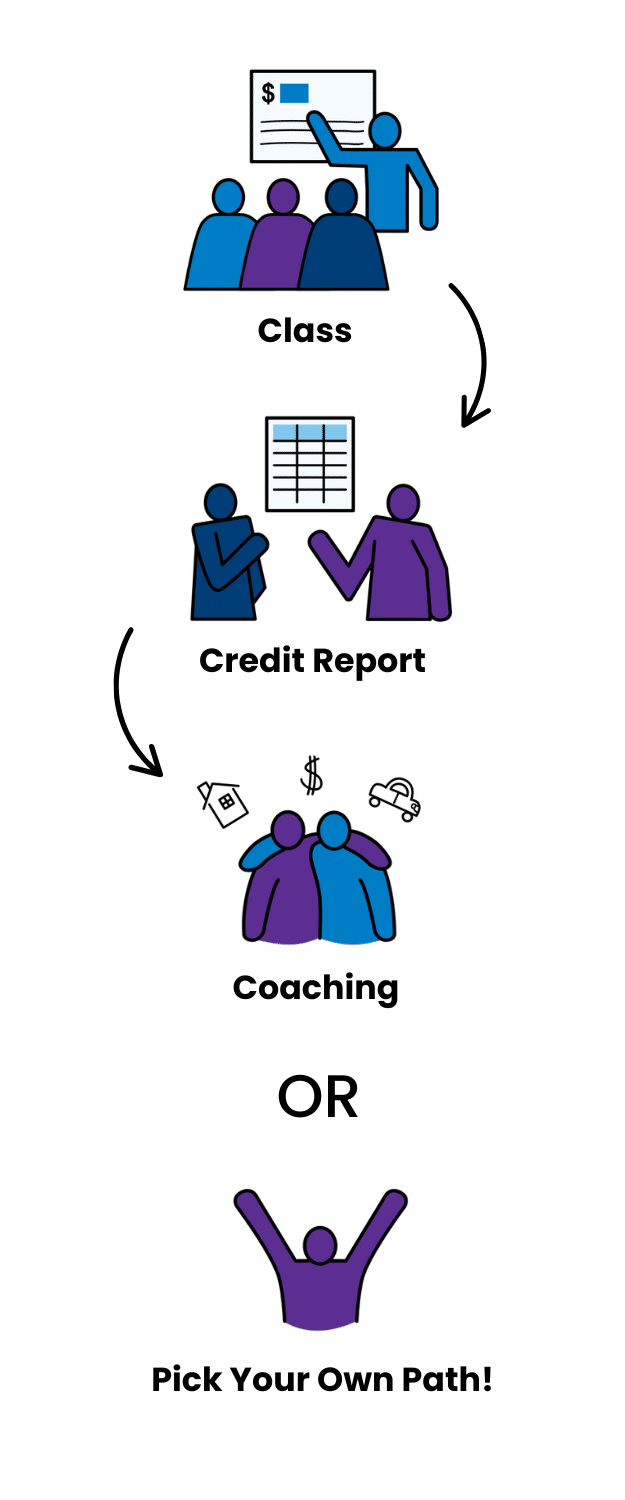

What a Typical Progression Might Look Like

We offer several pricing options and can tailor our services to meet your organization’s specific needs. Please contact Ben for more information!

Statistics from Bank of America’s 2024 “Workplace Benefits Report” and BrightPlan’s 2024 “The State of Financial Well-being” report.

Regina Fowler (She/Her)

Regina Fowler (She/Her) Aaron Tucker Jr. (He/Him)

Aaron Tucker Jr. (He/Him) Nikol Theberge (She/Her)

Nikol Theberge (She/Her) Andrea Stewart-Douglas (She/Her)

Andrea Stewart-Douglas (She/Her) Anniece Robinson (She/Her)

Anniece Robinson (She/Her) Elizabeth ‘Liz’ Myers (She/Her)

Elizabeth ‘Liz’ Myers (She/Her) Carrie Driscoll (She/Her)

Carrie Driscoll (She/Her) Joyce Kampwerth (She/Her)

Joyce Kampwerth (She/Her) Allison Cook (She/Her)

Allison Cook (She/Her) YaNan Bledsoe (She/Her)

YaNan Bledsoe (She/Her)