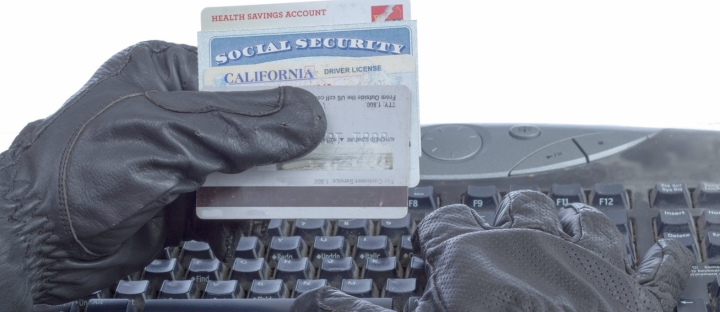

One of the most evil crimes of our modern time is identity theft. Identity theft is a form of fraud where someone steals your personal information such as your social security number, driver’s license, bank account details, or credit card information, without your consent or knowledge. With this information, an identity thief can commit financial fraud taking out credit, and buying houses and cars all in your name. According to IdentityTheft.org, there is a new victim of identity theft every 22 seconds. However when Identity theft strikes it’s never over, today we are going to cover some strategies to stay safe from identity theft and how to recover from it.

Methods of Identity Theft

These thieves use a variety of strategies to access your information. A data breach is one that can happen without you even doing anything. Large companies have had hackers breach their security and release their client’s private information. Another method is phishing, phishing is when they use bogus emails or messages designed to trick you into revealing your personal information like login information or social security. The hardest method to look out for is skimming, this is when thieves utilize devices known as skimmers to steal credit and debit card information from people at ATMs, gas pumps, or point-of-sale terminals.

What Can They Do With My Information?

Once thieves have your information they can do all sorts of financial fraud. They can open new credit card accounts, take out loans, or simply purchase things in your name. Some thieves lock people out of their accounts and withdraw all of the funds. Sometimes they don’t always go for the financial angle, some will use your identity for your medical benefits stealing medical services, prescriptions, or insurance benefits. Surprisingly, someone else may steal your ID to gain employment.

How Can Defend Myself Against Identity Theft

To defend yourself from identity theft protect personal information such as your social security number, driver’s license, and financial account numbers. Make sure to collect mail quickly and consider getting a locked mailbox or a P.O. Box. This helps prevent thieves from stealing documents like bank statements and credit card offers. When getting rid of bank statements and credit card offers make sure to shred them to prevent dumpster-diving identity thieves. On the digital side of things, creating complex passwords is a great way to protect yourself. A good password is a mix of uppercase and lowercase letters, numbers, and special characters. Alongside that never use the same password for all your accounts. Each account needs to have its own password. To add another layer of protection enable Two-Factor Authentication, this adds a second verification step, sometimes in the form of a text message code or fingerprint scan. For both the digital world and the real world be very cautious of who is asking for your your information. Never share login information via email or text, as trusted institutions won’t ask for it. Be cautious of suspicious promises, like doubling investments or grant qualifications, as these are smokescreens used to steal your information.

What Can I Do if This Happens to Me?

If you experience this, immediately notify your financial institutions (banks, credit card companies, and credit bureaus) to secure your account. Cancel credit and debit cards for added safety. Report skimming-type theft to local authorities for the skimmer’s removal. In case of a data breach, change passwords associated with the breached place even if nothing was stolen. Another resource for you to use is us at Prosperity Connection. Our amazing coaches here can help anyone assess the situation, make a plan, and offer suggestions on where to go next.

Identity theft can lead to numerous difficult situations for those affected, including financial fraud and misusing their identities. However, despite the headaches caused by identity theft, there are ways to protect oneself and recover from such incidents. You can protect yourself against identity theft by staying vigilant, promptly reporting suspicious activities to financial institutions, and taking preventive measures like changing passwords after a data breach. Additionally, maintaining awareness and refraining from sharing sensitive information via email or text can further safeguard against potential threats.